Discover How We Can Help You Build a Multi-Million Pound Property Portfolio & Become Asset and Cash Rich Fast!

Discover How We Can Help You Build a Multi-Million Pound Property Portfolio & Become Asset and Cash Rich Fast!

Join 1,000+ Successful Property Investors

Join 500+ Successful Property Investors

Property Mentors who have Have Been Trained by PortfolioBuilder.team's Founder, Vincent Wong

Paul McFadden

John Lee

Valter Pontes

Paul Preston

Peng Joon

Karol Ying

Milan Doshi

Marina de Haan

Ready to Grow Your Property

Portfolio?

Property Mentors Trained by PortfolioBuilder.Team's Founder, Vincent Wong

Samuel Leeds

John Lee

Paul McFadden

Paul Preston

Milan Doshi

Valter Pontes

Peng Joon

Karol Ying

Marina de Haan

Ready to Grow Your Property Portfolio?

Book a Chat to Explore How You Can

Secure Below-Market Properties and

Boost Your Passive Income

Have you ever wondered how some investors can own multiple properties and enjoy a passive income while others struggle to buy one or two properties?

The reason for that is that seasoned investors use very specific strategies which do not just involve saving for deposits and getting standard "buy-to-let" mortgages. For a start, to get a buy-to-let mortgage, you would need to put down 25% deposit and that would take you years before you get to save up enough money. By then property prices would have probably doubled!

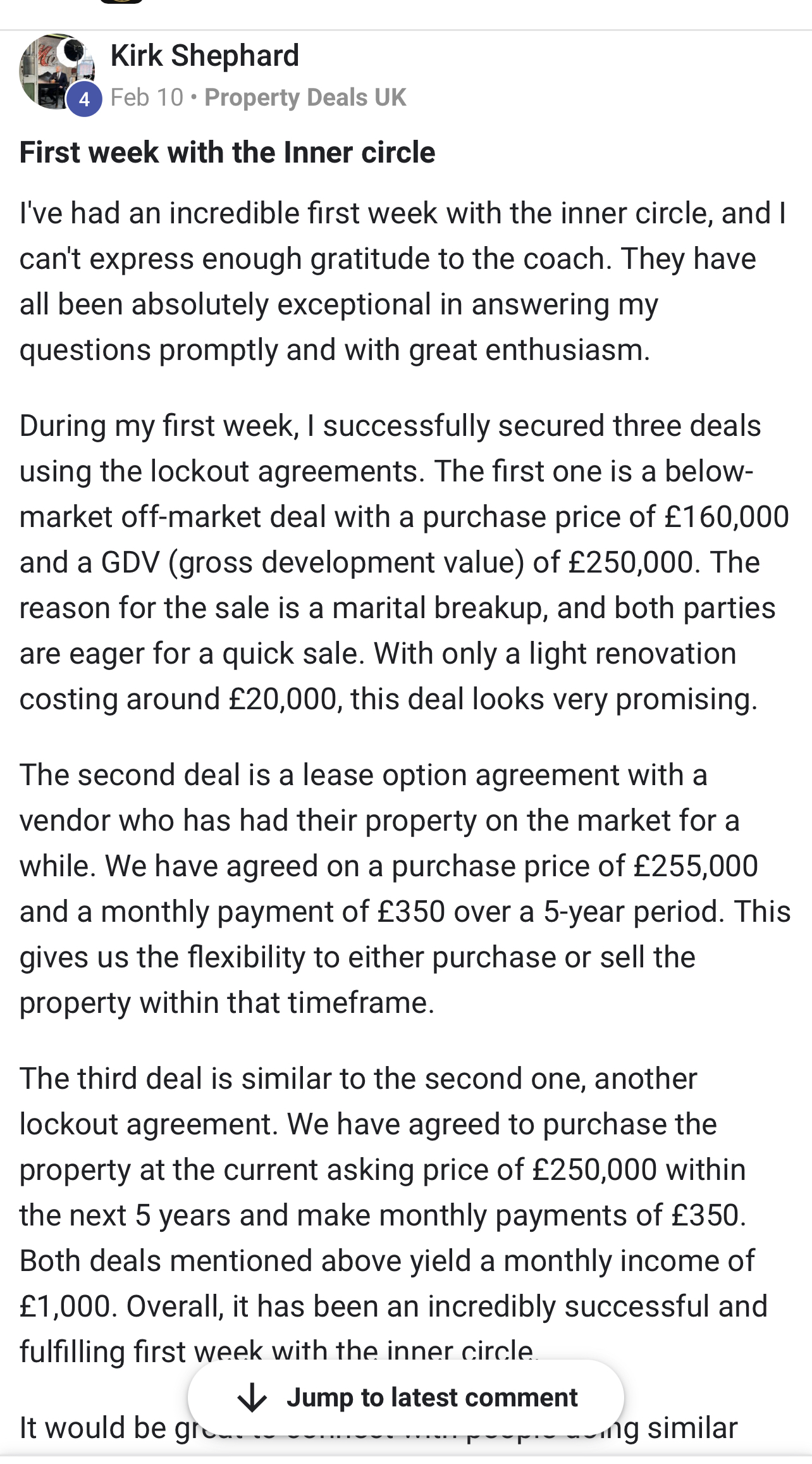

Over the past 15 years, thousands of people around the world, from beginners to experienced investors, have benefitted from applying my powerful but lesser-known strategies that have allowed them to build their assets and passive income quickly and safely.

Want to know how this could work for you? Sign up for my next free masterclass now and you would be wondering why you hadn't done this sooner!

Watch this interview below discussing the truth about buying property without using mortgage finance

IGNORE THE HYPE

The people who tell you that properties are selling so fast are the estate agents. They want to discourage you from putting in low offers so they can earn more commission. Never listen to them. Instead start by knowing the "value" and you put in an offer based on that. Never try to be the highest bidder. Property is also a numbers game and deals are everywhere if you know where to look.

It's Not Just About the Locations

Your due diligence process has to uncover any hidden danger that could lose you money. Did you know that Japanese Knotweed could eat into the structure of your external walls and cause some serious damage? You also need to ensure that there are no restrictions on the title that could be a liability to you once you have purchased the property.

Access Your Capital

Apart from your savings and getting mortgage loans, there are many ways to access capital to help you kick start and grow your property portfolio. A good investor knows how to use OPM, that stands for "other people's money". Right now there are savers who are losing money in their banks due to inflation and are looking for opportunities to invest for a higher return.

Recycle Your Capital

Good investors also know how to make their capital work hard for them. The deposit you used to buy your next property needs to be "recycled" so that you can continue to buy more property. Did you ever wonder how some investors could own tens or hundreds of property while others struggle to get on the property ladder? Recycling your capital is the key.

Know Your Risks

Risks and rewards go hand in hand but how do you access risks? You want to make sure that you don't lose out on any opportunities but also, you must assess the risk and reward ratios to help you make better decisions.

Never Ask For a Discount

When you ask for a discount, you will never get one! The reason for that is that all the prices you find on portals are inflated so you will never get a genuine discount. Instead, you need to know where the deals are and it's rarely through estate agents.

Never Rely On Just The Rental

If you have to replace a boiler, it could wipe out a few months of your rental profit! Professional investors have multiple sources of income. For example, flipping a deal for cash is risk free and could earn you more in one deal than six months of your salary.

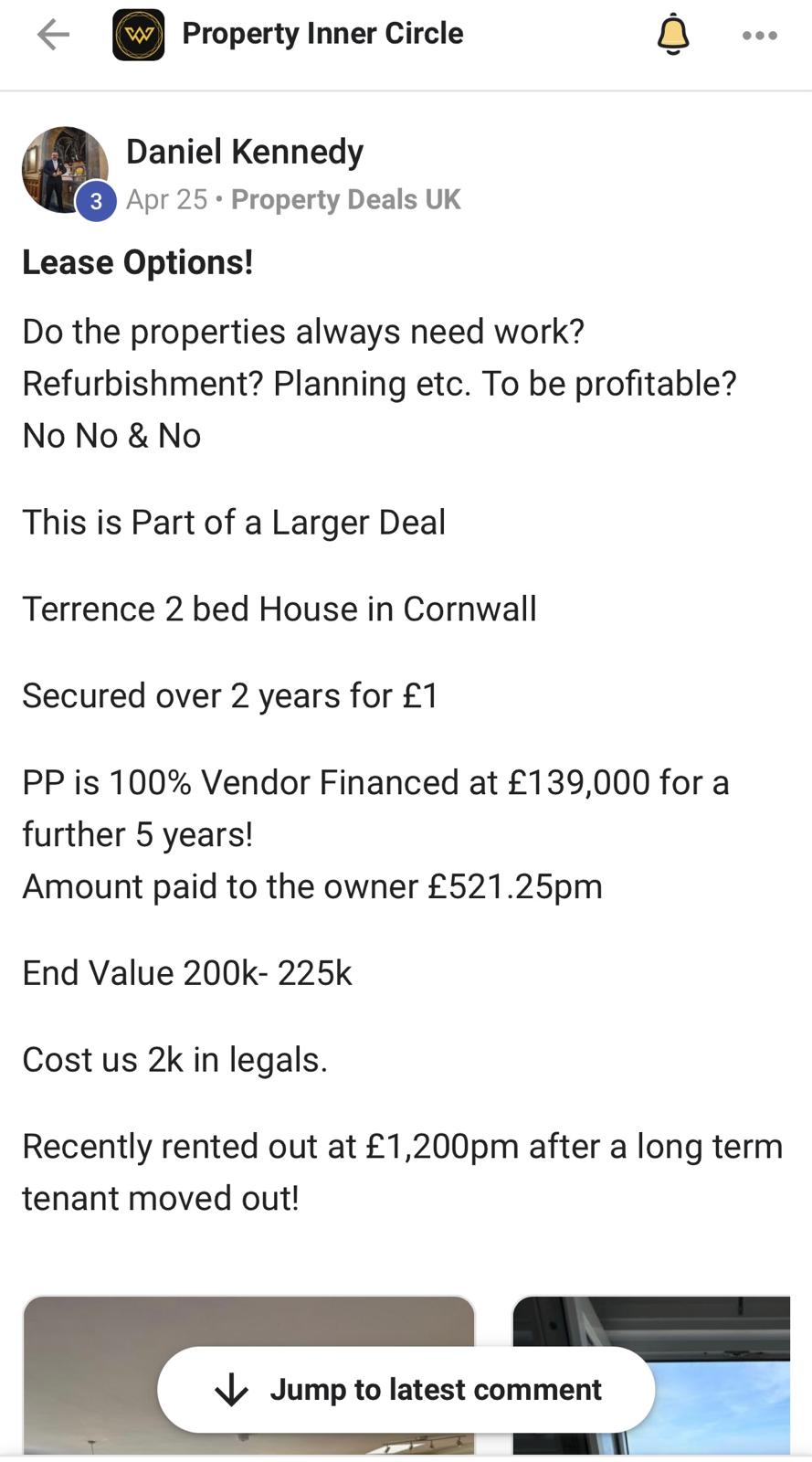

Ownership Is Not The Answer

According to John D Rockefeller, the key to wealth is to "control everything and own nothing". Controlling assets through negotiating on the terms is for those who wish to take their property investing to the next level.

Book a Chat to Explore How You Can

Secure Below-Market Properties and

Boost Your Passive Income

Have you ever wondered how some investors can own multiple properties and enjoy a passive income while others struggle to buy one or two properties?

The reason for that is that seasoned investors use very specific strategies which do not just involve saving for deposits and getting standard "buy-to-let" mortgages. For a start, to get a buy-to-let mortgage, you would need to put down 25% deposit and that would take you years before you get to save up enough money. By then property prices would have probably doubled!

Over the past 15 years, thousands of people around the world, from beginners to experienced investors, have benefitted from applying my powerful but lesser-known strategies that have allowed them to build their assets and passive income quickly and safely.

Want to know how this could work for you? Sign up for my next free masterclass now and you would be wondering why you hadn't done this sooner!

Watch this interview below discussing the truth about buying property without using mortgage finance

IGNORE THE HYPE

The people who tell you that properties are selling so fast are the estate agents. They want to discourage you from putting in low offers so they can earn more commission. Never listen to them. Instead start by knowing the "value" and you put in an offer based on that. Never try to be the highest bidder. Property is also a numbers game and deals are everywhere if you know where to look.

It's Not Just About the Locations

Your due diligence process has to uncover any hidden danger that could lose you money. Did you know that Japanese Knotweed could eat into the structure of your external walls and cause some serious damage? You also need to ensure that there are no restrictions on the title that could be a liability to you once you have purchased the property.

Access Your Capital

Apart from your savings and getting mortgage loans, there are many ways to access capital to help you kick start and grow your property portfolio. A good investor knows how to use OPM, that stands for "other people's money". Right now there are savers who are losing money in their banks due to inflation and are looking for opportunities to invest for a higher return.

Recycle Your Capital

Good investors also know how to make their capital work hard for them. The deposit you used to buy your next property needs to be "recycled" so that you can continue to buy more property. Did you ever wonder how some investors could own tens or hundreds of property while others struggle to get on the property ladder? Recycling your capital is the key.

Know Your Risks

Risks and rewards go hand in hand but how do you access risks? You want to make sure that you don't lose out on any opportunities but also, you must assess the risk and reward ratios to help you make better decisions.

Never Ask For a Discount

When you ask for a discount, you will never get one! The reason for that is that all the prices you find on portals are inflated so you will never get a genuine discount. Instead, you need to know where the deals are and it's rarely through estate agents.

Never Rely On Just The Rental

If you have to replace a boiler, it could wipe out a few months of your rental profit! Professional investors have multiple sources of income. For example, flipping a deal for cash is risk free and could earn you more in one deal than six months of your salary.

Ownership Is Not The Answer

According to John D Rockefeller, the key to wealth is to "control everything and own nothing". Controlling assets through negotiating on the terms is for those who wish to take their property investing to the next level.

ABOUT THE FOUNDER

VINCENT WONG

Vincent began building his property portfolio in 2000 while working as a community pharmacist in the UK. By 2005, he had developed an innovative approach to finding property sellers online, and has since sourced, negotiated and closed over 1,000 property deals for himself and his investors.

In 2008, amid the financial crisis, Vincent pioneered the use of Lease Option to control assets without using mortgage financing or deposits. The following year, he co-founded Wealth Dragons to teach his revolutionary strategies. His training programs have educated over 10,000 people worldwide.

Vincent has authored several books, including Property Entrepreneur (Wiley), and is a regular expert on Property Question Time on Sky TV.

ABOUT THE FOUNDER

VINCENT WONG

Vincent Wong is the co-founder and CEO of Wealth Dragons Group PLC, a fast-growing education provider in the self-development industry. He is the author of Property Entrepreneur and co-author of The Wealth Dragon Way.

Vince is one of the most dynamic and well-respected property entrepreneurs internationally. Since gaining his MBA in 1997, Vince has built a successful property business through helping countless people source and structure property deals.

At the height of the financial crisis, he made history in several countries where he transacted property deals without using any money by following the motto of John D Rockefeller that the secret of wealth is to "own nothing but to control everything".

As an internationally recognised public speaker, Vince is passionate about sharing his knowledge gained from a business career spanning 20 years. Today, he is dedicating his time to expanding his company by utilising technology to promote self-education and making it available to all.

Watch Vincent Wong on Sky Channel 186

Ready to Amplify Your

Property Income?

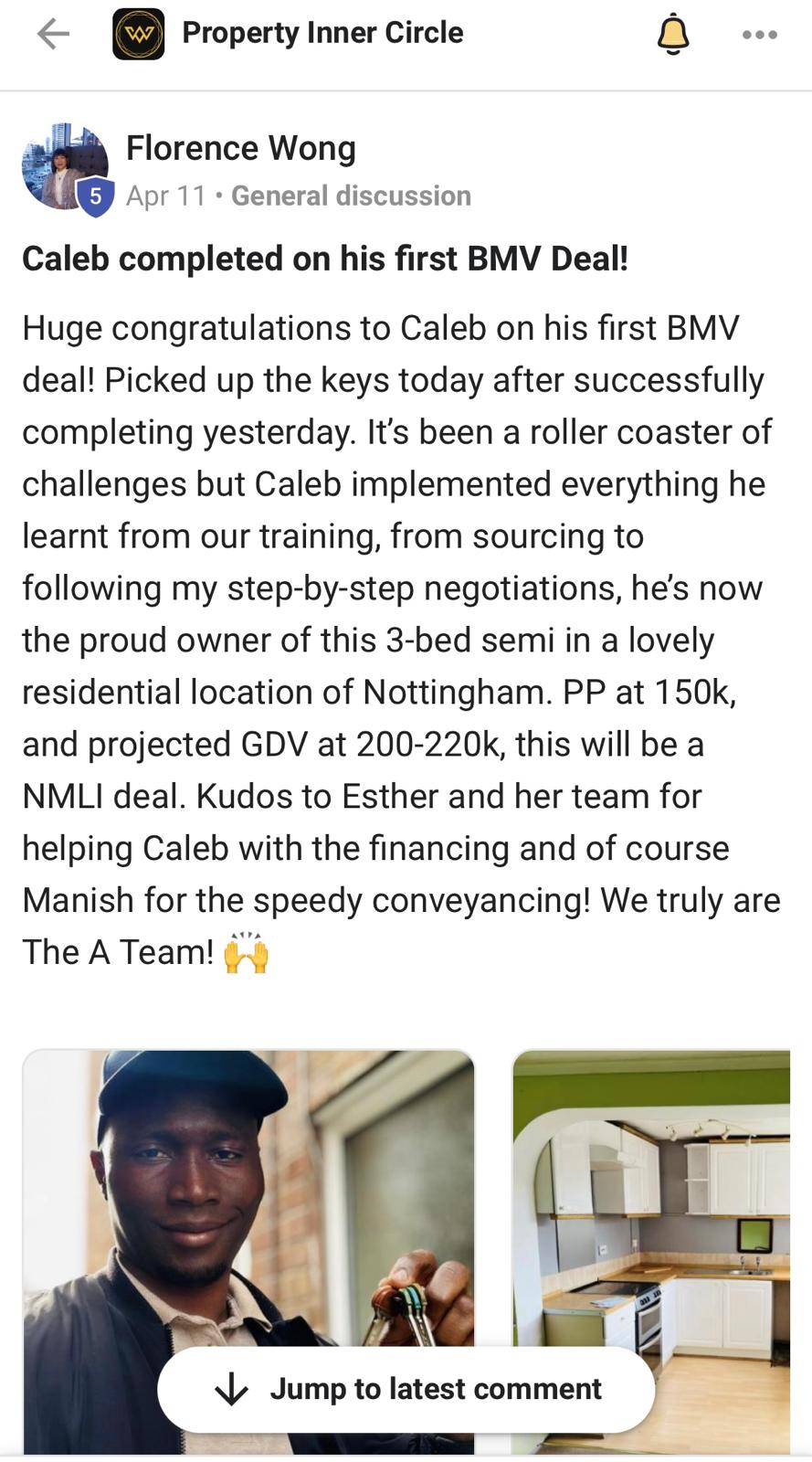

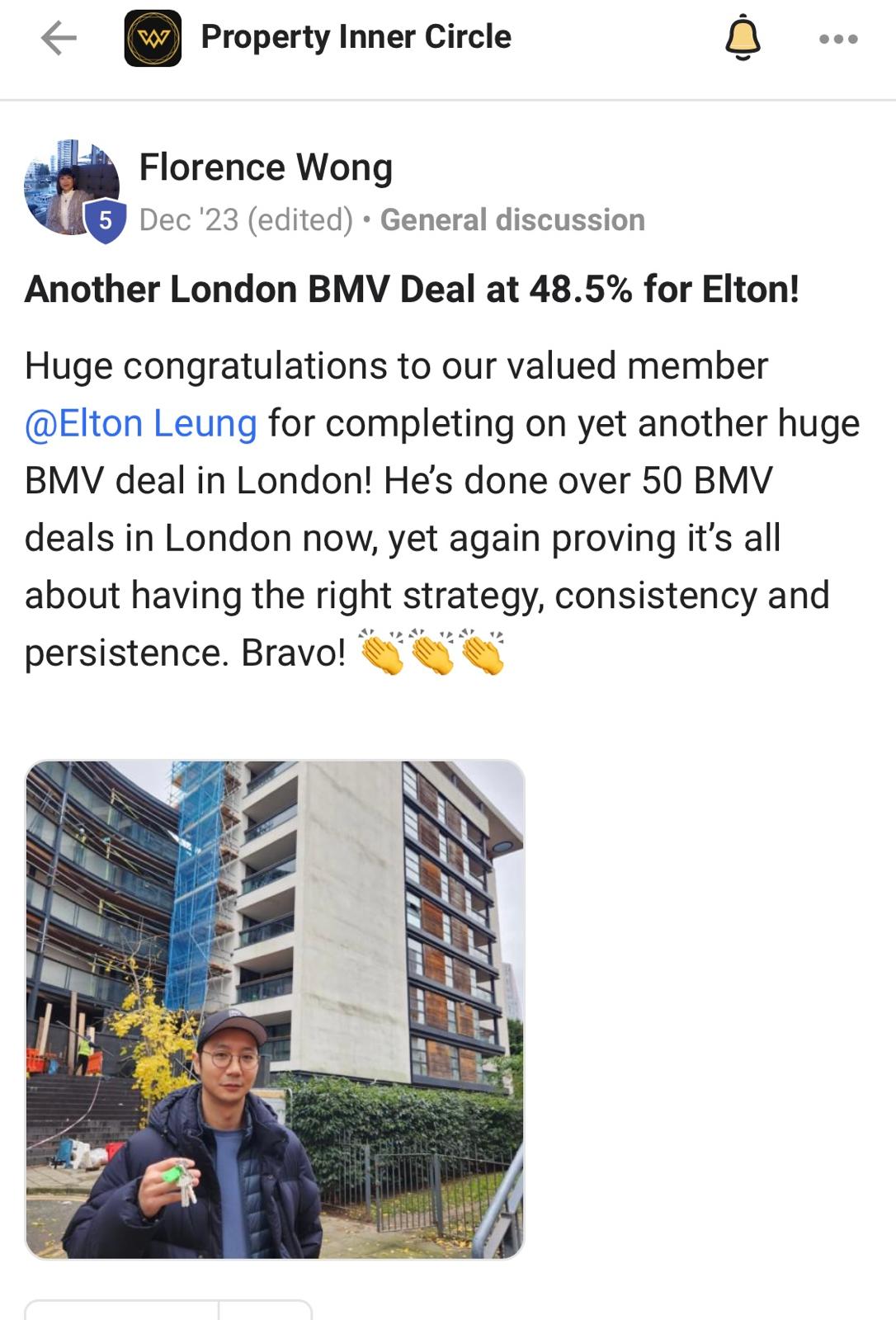

WATCH THEIR STORIES

TRANSFORMING LIVES, ONE

PROPERTY AT A TIME

Jules Built £100k in Equity within 6 Weeks

Daniel Made £169,919 Cash in First Flip

Maha Made £340k Instant Equity in Battersea Deal

Sean Made 210k Cash in One Flip

Paul Bought 6 Properties in 6 Months

Matthew Controlled £2.1m Hotels for £10k

Yawor Created £3.1m Portfolio

Valter Acquired 6 Properties in London

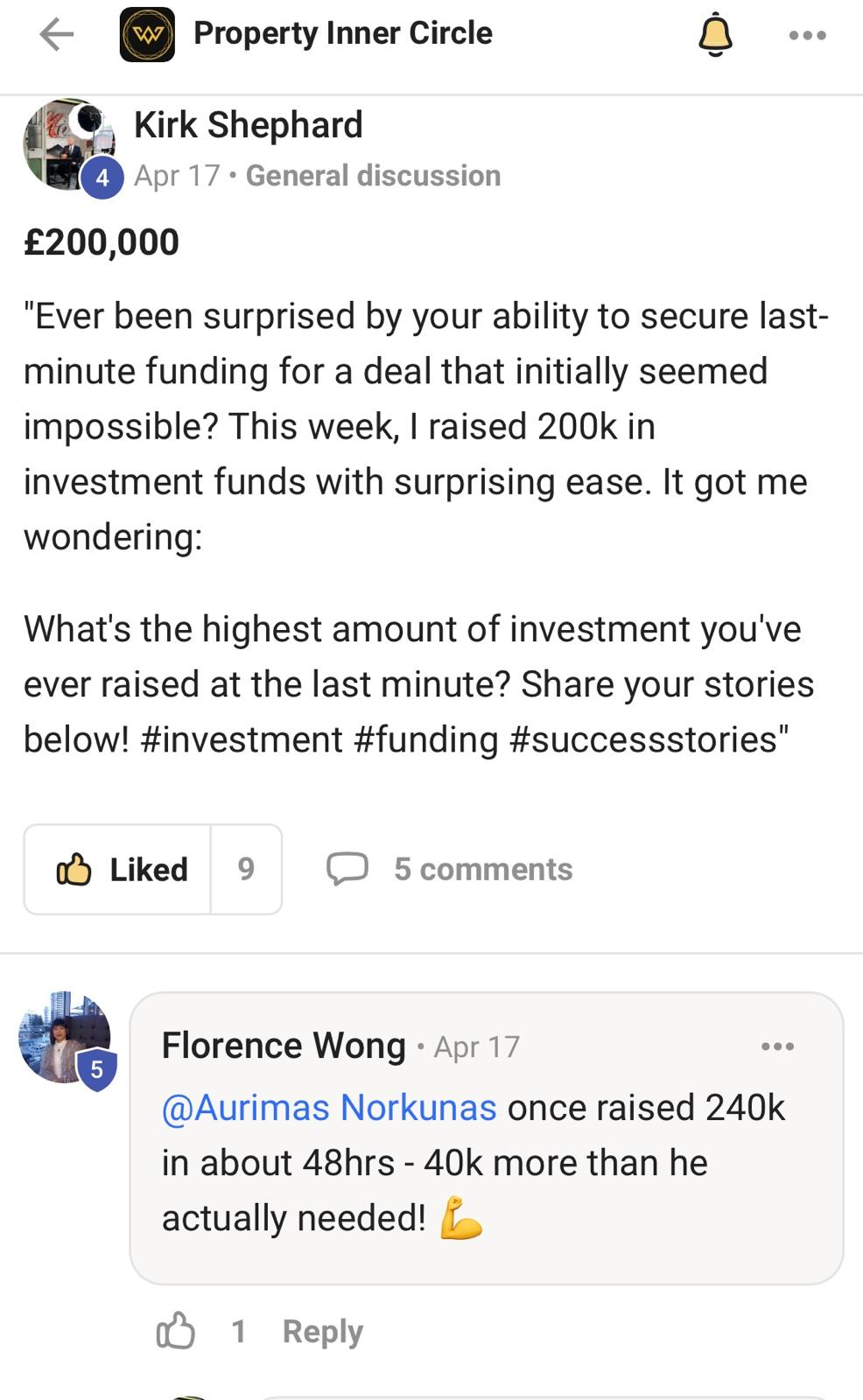

Auramas Raised £210k For First Deal

Steve Bought £150k Property for £100k

Colin Flipped 70 Property Deals

Katie did First Lease Option Deal in 3 Weeks

Ready to Amplify Your

Property Income?

WATCH THEIR STORIES

TRANSFORMING LIVES, ONE

PROPERTY AT A TIME

Maha Made £340k Instant Equity in Battersea Deal

Sean Made 210k Cash in One Flip

Paul Bought 6 Properties in 6 Months

Matthew Controlled £2.1m Hotels for £10k

Yawor Created a £3.1m Portfolio

Valter Acquired 6 Properties in London

Daniel Made £169,919 Cash in First Flip

Sean Made 210,000 Cash in First Flip

Steve Bought £150k Property for £100k

Colin Flipped 70 Property Deals

Auramas Raised £210k For First Deal

Katie Did First Lease Option Deal in 3 Weeks

FAQ

How does Portfolio Builder help me build a £5m property portfolio?

Wealth Dragons specializes in teaching unique strategies for buying properties significantly below market value. Our approach focuses on maximizing your investment potential, allowing you to build a substantial property portfolio and generate passive income efficiently.

Do I need a lot of capital to start investing in property?

Not necessarily. One of our key strategies involves investing in property without needing large deposits or heavy mortgages. We guide you through alternative financing options, making property investment accessible even if you have limited initial capital.

Can beginners in property investment benefit from your program?

Absolutely! Our program is designed for both beginners and experienced investors. We provide comprehensive education and support, ensuring that even those new to property investment can confidently make informed decisions and grow their portfolios.

How quickly can I expect to see returns on my property investments?

The timeline for returns can vary based on market conditions and individual strategies. However, many of our clients start to see significant growth in their portfolios and passive income within a few months of applying our methods.

Are the strategies taught by Wealth Dragons legally compliant?

Yes, all the strategies we teach comply with current legal standards. We prioritize ethical and legal approaches to property investment, ensuring you build your portfolio on a solid and compliant foundation.

What support does Wealth Dragons offer to its clients?

We offer comprehensive support including mentorship, access to a community of fellow investors, ongoing educational resources, and regular updates on market trends and strategies. Our goal is to ensure you have all the tools and knowledge needed for successful property investment.

Join 1,000+ Prosperous Property Investors

FAQ

How does Wealth Dragons help me build a £5m property portfolio?

Wealth Dragons specializes in teaching unique strategies for buying properties significantly below market value. Our approach focuses on maximizing your investment potential, allowing you to build a substantial property portfolio and generate passive income efficiently.

Do I need a lot of capital to start investing in property?

Not necessarily. One of our key strategies involves investing in property without needing large deposits or heavy mortgages. We guide you through alternative financing options, making property investment accessible even if you have limited initial capital.

Can beginners in property investment benefit from your program?

Absolutely! Our program is designed for both beginners and experienced investors. We provide comprehensive education and support, ensuring that even those new to property investment can confidently make informed decisions and grow their portfolios.

How quickly can I expect to see returns on my property investments?

The timeline for returns can vary based on market conditions and individual strategies. However, many of our clients start to see significant growth in their portfolios and passive income within a few months of applying our methods.

Are the strategies taught by Wealth Dragons legally compliant?

Yes, all the strategies we teach comply with current legal standards. We prioritize ethical and legal approaches to property investment, ensuring you build your portfolio on a solid and compliant foundation.

What support does Wealth Dragons offer to its clients?

We offer comprehensive support including mentorship, access to a community of fellow investors, ongoing educational resources, and regular updates on market trends and strategies. Our goal is to ensure you have all the tools and knowledge needed for successful property investment.

Join 500+ Prosperous Property Investors